Finance Best Practices, Financial Sustainability

Four Disciplines for Leading Through Financial Uncertainty

Insight Categories

It’s safe to say education leaders are dealing with one of the most uncertain financial periods in recent memory. The end of one-time ESSER funding. Enrollment declines. Policy volatility. State budget pressures. All of these forces are conspiring to create a uniquely complex environment for public education decision-making.

Education leaders from the school to the district to the state are making difficult choices, often with incomplete information, while maintaining staff morale and without losing the trust of the community.

But while we can’t control federal budgets or birth rates, there are things we can control. We can control how we plan. How we communicate. How we decide to show up as leaders.

At the local school system level, I believe there are four essential strategies that leaders can employ to navigate this environment. And while they won’t make your problems go away or make your jobs easier, I believe leaning into these four areas will help you serve your communities with greater confidence.

Discipline 1: Communicate with Clarity and Transparency

In uncertain times, when leaders are silent, people get anxious. It’s important to name the uncertainty, to address the proverbial elephants in the room.

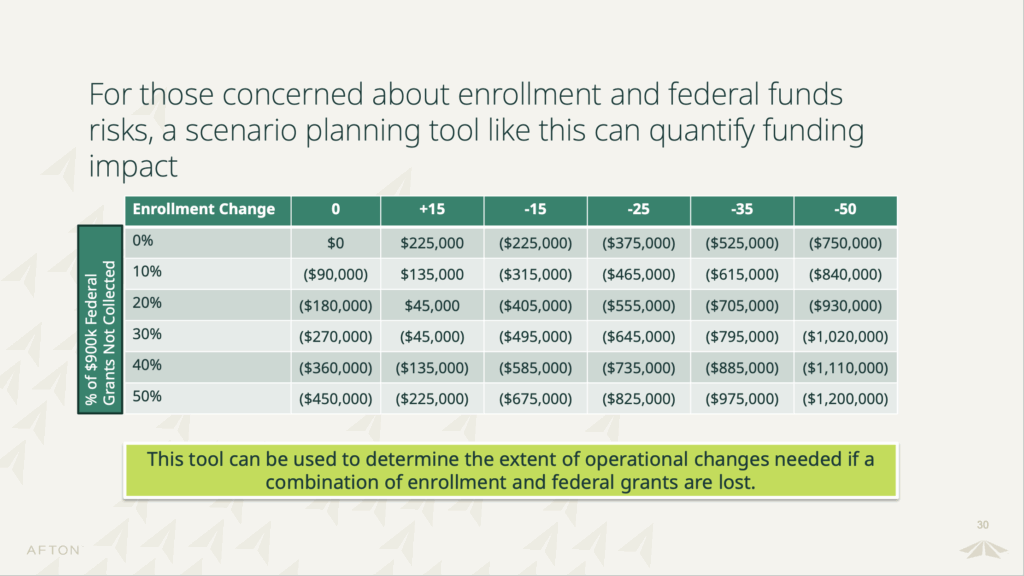

Consider your board and finance committee. Share data about enrollment, funding, student needs, and cost trends. Don’t just describe the risks, make an attempt to quantify them. And outline the second-and-third-order effects on things like compensation, facilities, or growth.

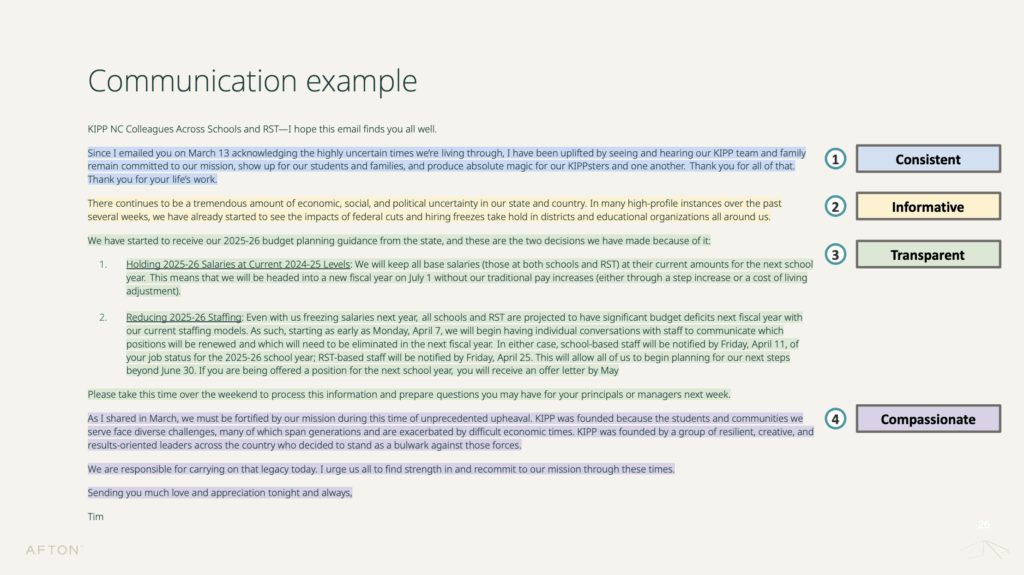

Consider transparency with your staff on your operating context. While that might feel risky, we tend to find they appreciate hearing the same data and context that leadership is weighing. It’s important that this messaging be consistent, informative, transparent, and compassionate. We appreciated this example from KIPP North Carolina last year.

Finally, make sure your finance committee continues to function well. Maintain a consistent meeting cadence. Include members that are financially literate and capable of balancing rationality and empathy. A well run committee will help strengthen your own decision-making and provide appropriate checks on your logic when weighing hard decisions.

Discipline 2: Manage Risk with Scenario Planning

No plan fully survives contact with reality, even in the best of times. It’s certainly true right now. That’s why Afton urges school system leaders to scenario plan on their financial outlook – toward effective decision making on instructional strategies.

Start by identifying your major areas of financial risk. That could be state and federal budget risk. It could be rising student needs. It could be enrollment variability. It could the construction costs or facility maintenance costs.

For each, model out the base scenario, the best-case scenario, and the worst case scenario. You want to see the impacts of each, some, and all at once.

You are trying to be ready to act decisively no matter what version of the future arrives.

Discipline 3: Protect Cash to Preserve Flexibility

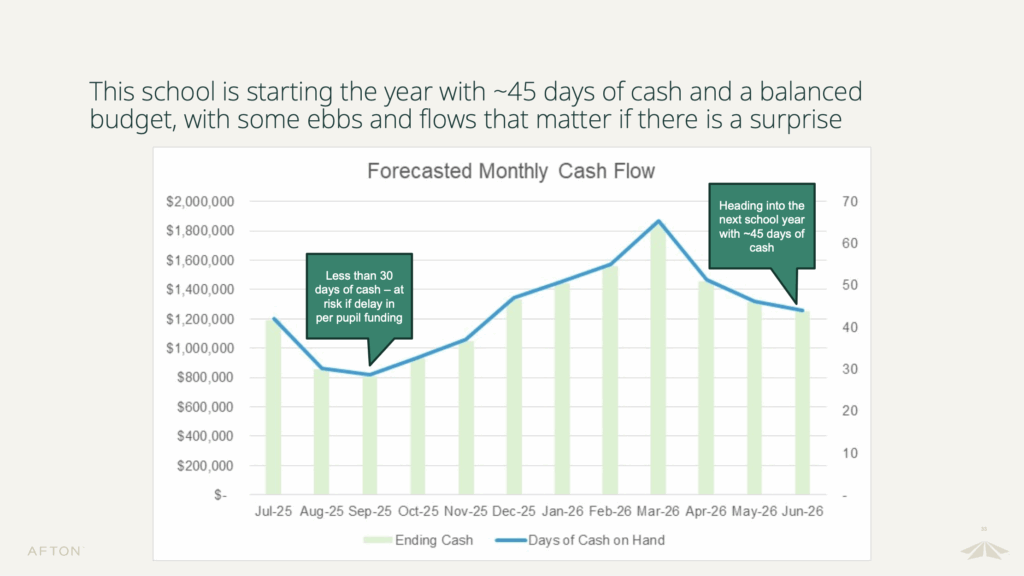

Even financially healthy schools and school systems can be whipsawed by reimbursement delays or enrollment timing. It’s imperative to have solid cash management practices to give your organization sufficient breathing room when surprises inevitably arrive.

Some concrete recommendations:

- Keep at least 45-90 days of cash on hand.

- Exercise discipline around submitting grant reimbursements promptly.

- Start the process of establishing revenue anticipation notes or lines of credit now. The best time to do this is before you need it.

- For smaller school systems and charter schools with limited access to capital, regularly project your monthly cash flow and update it each month. What gets measured gets managed.

Leaders must be able to forecast these dips and act early by adjusting spending, delaying large purchases, etc.

Discipline 4: Strengthen and Diversify Revenue

Enrollment management is becoming a more common lever to influence the revenue side of the equation for public and charter schools alike. Any organization that relies on per-pupil funding can benefit. Setting data-driven enrollment targets, investing in marketing systems and staff, and monitoring progress and course correcting as needed are all core skills in doing this work well.

Schools can also explore diversified revenue strategies to avoid single points of failure. What programs and services are you offering that are eligible for funding outside of the typical K-12 funding formula? Grants, philanthropic partners, fee-based services (after-school, summer schools/camps, facility rentals, etc.) and interest-bearing investments on reserves can all contribute to incremental revenue increases. When things tight, even small adjustments matter.

Lean In To What You Can Control

In periods of tremendous uncertainty, education leaders have the power to plan, to communicate, to anticipate. And by doing so can lead their communities with conviction, with steadiness, and with compassion.