Financial Sustainability

Navigating Uncertainty and Preparing for the Education Fiscal Cliff

Some public school systems, including several who Afton is currently supporting, are already charting their path to navigating their fiscal cliff. While each circumstance is different, we offer guidance to navigate the challenge, co-developed in partnership with the Charter School Growth Fund.

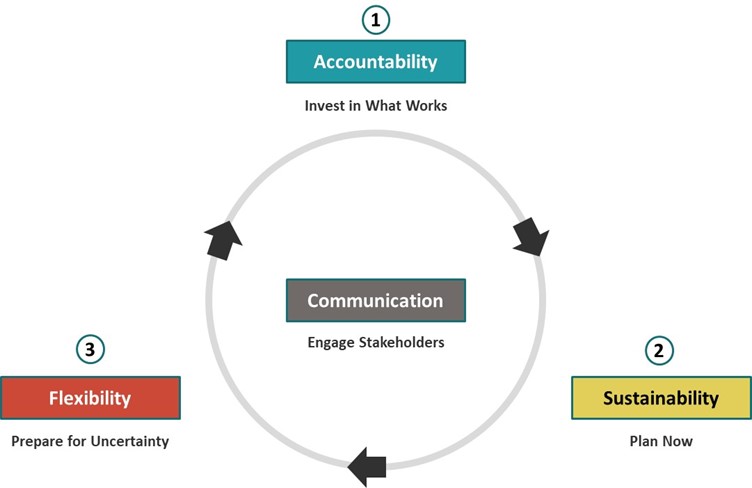

Our guidance includes:

- Understand and confront the reality

- Engage and empower stakeholders

- Identify, invest in, and prioritize what works for students, staff, and families

- Plan now for sustainability

- Remain flexible to what may change

The first step here is understanding and confronting the reality. This includes developing a multi-year financial forecast to quantify the fiscal problem. Identify and communicate the forces causing a forecasted fiscal deficit, which include:

- ESSER funds: These federal relief dollars must be obligated by September 2024 and expire thereafter. These funds have been integral to learning recovery investments and providing stability for school systems as much else in the operating environment has been unstable.

- Economy: Since COVID-19, the cost of facility debt financing has risen while inflation and the corresponding cost of services and personnel has skyrocketed. Uncertain economic forecasts lead to some question about how sufficiently future tax dollars that support state education funding with increase correspondingly

- Enrollment: NCES forecasts that through 2030, only five states will experience increased public school enrollment. In fact, this year’s tenth grade class is the largest class in the K12 system, and there will be 4% less enrollment in public schools across the nation in 2030 compared to 2019.

- Talent: According to the IES School Pulse Panel, 53% of public schools reported feeling understaffed entering the 2022-2023 school year. And Teaching vacancies are more prevalent in high-minority schools and schools in high-poverty neighborhoods.

However unjust this circumstance is, we must navigate the situation in student-centered and values-driven ways across stakeholders.

COMMUNICATION: Engage and Empower Stakeholders

Engaging and empowering stakeholders in the change process can provide a meaningful and comprehensive path for determining the appropriate changes for navigating the fiscal cliff.

- Lead with your values. Set guiding principles for change grounded in your organization’s values. Make communication and engagement commitments you know you can keep.

- Empower your team. Consider how those most impacted by change and those accountable for spending might lead this change work. How might your finance function inform rather than lead the work to address the fiscal cliff? Identify the roles you want each part of your organization and each stakeholder group to play in operational decision-making.

- Communicate reality. Change requires buy-in on why it’s necessary. That communication on the problem is critical underpinning before jumping to the solutions. Maintain the discipline to communicate the facts of your current environment. Approach conversations about resources with empathy and transparency. Change requires buy-in on why it’s necessary.

- Tell the story. Each stakeholder group has a potential powerful role in being the ambassador of your progress story. Leverage your ecosystem and advocacy support.

ACCOUNTABILITY: Know What Works & Prioritize It

- Identify what works. Identify aspects of your schools and similar schools that are contributing to positive student experience and value for parents and students. Develop and implement a plan to organize your school community to gather and analyze this data.

- Prioritize. Identify the resource implications – programs, staffing, schedules – of your strategies that are working. Use your remaining one-time funds to support high impact learning recovery investments and non-recurring commitments that you won’t be able to afford in the future. Leverage your stakeholders to identify aspects of your operations that might have to change (levers include school-wide schedules, enrollment, fundraising, cohort sizes, transportation, maintenance schedules, ancillary services, refinancing). Iterate with your financial planning toward finalizing your operating priorities.

SUSTAINABILITY: Plan Now

- Protect & Grow Revenue. Focus on enrollment: Invest to ensure family engagement is a top priority and a core competency. Take advantage of opportunities to maximize grade level cohorts. Invest in relationships that can lead to fundraising investments.

- Scenario Plan. Understand potential financial impact of recession on state revenues. Run projections for the years that ESSER funds go away. If you don’t change operations, what is the financial impact on the organization and each school? Build plans for up, base, and down scenarios in enrollment and public funding. Identify targeted opportunities to reduce expenses in downside scenarios.

- Establish & Reinforce Guardrails. Clarify your school system’s most important financial guardrails – loan covenants, liquidity needs, financing goals, etc. Communicate with key stakeholders your approach to ensuring long-term health of organization while navigating today’s opportunities and challenges.

FLEXIBILITY: Prepare for Uncertainty

- Monitor financial health. Develop a financial health dashboard and set a cadence for discussion of strengths and risks on at least a quarterly basis. Develop rolling 12-18 month cash flow forecast, as needed.

- Build Liquidity. Increase your cash target (we recommend >90 days) to provide flexibility in times of high uncertainty. Establish or renew a line of credit or revenue anticipation note. Ensure you’re claiming federal and other grant funding regularly.

- Stay Scrappy. Limit new ongoing commitments. For example, when possible/reasonable, make strategic one-time investments (contractors, bonuses, etc) to avoid paying for recurring expenses with short-term funds. Consider staging/scaling facilities projects, rather than taking on new debt during a time of elevated cost of financing. Budget conservatively on inflation and per pupil funding assumptions.

Contents of this post were developed in a collaboration of Afton Partners and Charter School Growth Fund.