Using Your Charter School Finance Committee for Impact and Sustainability

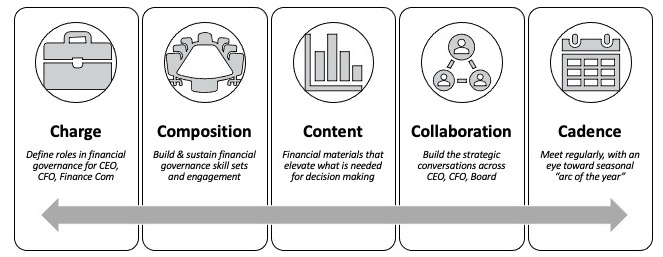

At Afton Partners, we advise our charter school partners to follow the framework of the “5 Cs” when developing and evolving their organization’s financial governance. The “5 Cs”– Charge, Composition, Content, Collaboration, and Cadence– provide a roadmap for cultivating strategic thinking and effective decision-making with your board, all meant to elevate and sustain what’s working in your schools.

The 5 Cs of Charter School Financial Governance

The 5 Cs of school financial governance are arranged in a line.

Charge: Who is responsible for the financial decision-making process for charter schools?

To ensure a seamless sharing of responsibility, it’s an important first step to define everyone’s roles clearly. For instance, the leadership team is primarily responsible for the daily leadership and execution of the priorities set in collaboration with the Board. The Board provides oversight and accountability and ensures fidelity to the plan, including the financial plan. Blurred lines can lead to the co-managing of the budget–not an optimally effective or desirable approach. On the other hand, administrators should feel supported and not solely responsible for the organization’s financial strategy and health. Everyone has an equally important and distinct role in the stewardship of the school’s financial resources.

Setting shared expectations– with an understanding that roles will grow and evolve as the school network grows– builds trust and lessens confusion around how decisions are made and who will execute which pieces.

For example, when it comes to financial decision-making, the school board finance committee serves as a consultant, ambassador, and governing body. The CFO has the important role of collaborator, content creator, and guide to strategic decision-making. And, contrary to what some may believe, the CEO has an important role in ensuring a strong board composition, board engagement and collaboration, and guide in strategic decision-making alongside the finance committee.

Composition: Who should be on a charter school finance committee?

A charter school board finance committee carries out the principal aspects of the board’s financial duties. They set fiscal policies and expectations, continually assess the financial health and direction of the school or network, and make strategic financial decisions in alignment with the broader strategic plan.

To carry out these duties, a strong board finance committee should consist of diverse professional backgrounds and skills, including business strategy and operations; banking; fiscal planning, management, and analysis; and real estate. Board members leverage their expertise and connections in their respective areas to strengthen and sustain the school or network’s financial standing.

In our practice, we find that taking care to build and sustain your board’s financial skillsets and engagement translates to high impact.

Content: What information is important for effective financial governance?

The Finance Committee should have the materials and data needed to make decisions that support long-term sustainability and align the budget to the overall priorities. Examples include:

- Year-to-date financial statements, compared to budget

- Long-term financial projections

- Cash flow monitoring

- Current key performance indicators and up-to-date financial reporting on those metrics

- Metrics on debt compliance and authorizer standards

With this information, the committee can then develop or revise standard metrics criteria across key performance areas (e.g., cash, enrollment, fundraising, net assets, etc.) and decide on targets. Part of each meeting should be devoted to evaluating progress towards the targets.

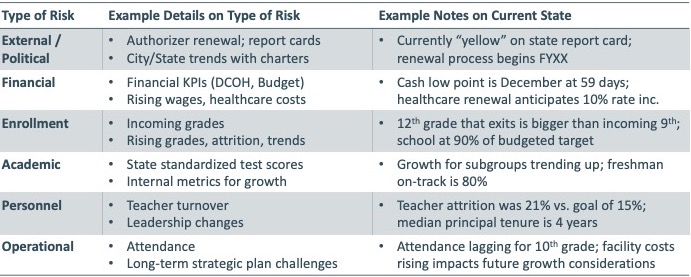

To mitigate challenges toward those goals, the committee should also monitor the organizational risks related to financial planning and decision-making.

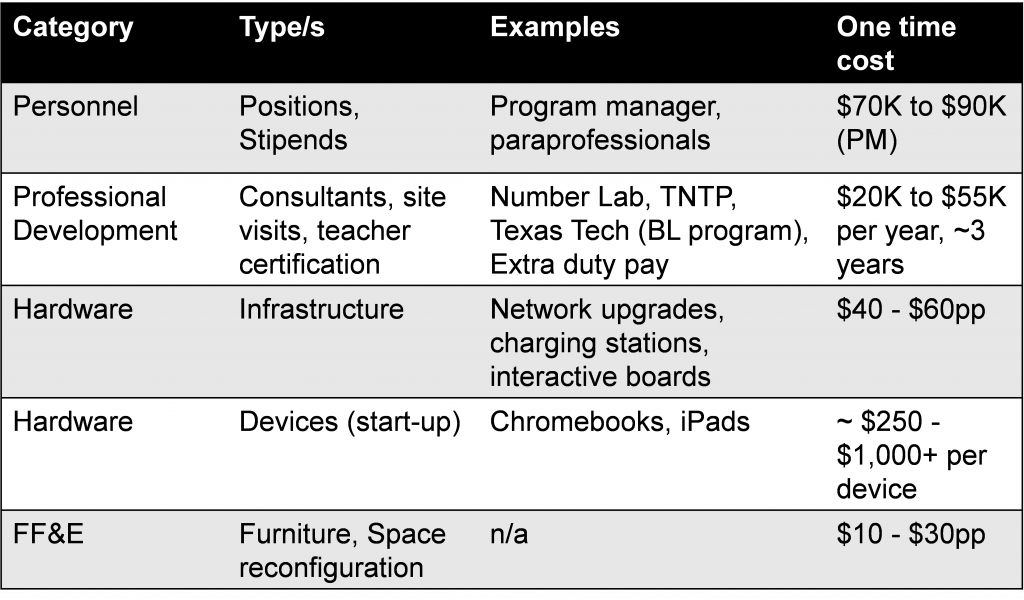

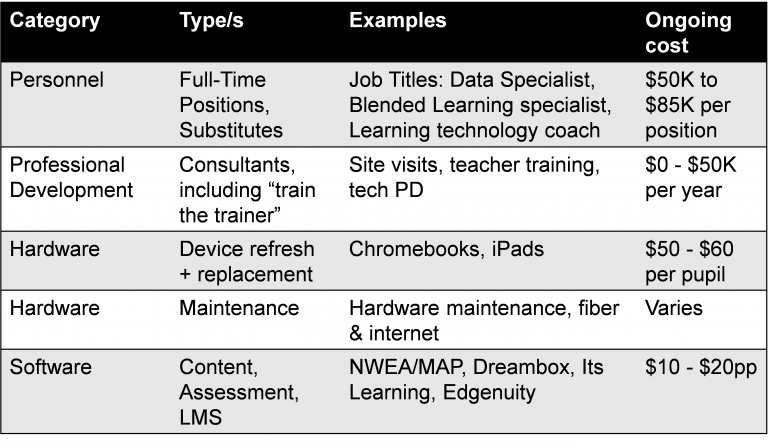

The table details types of risks charter school finance committees encounter and examples of those risks.

Example categories that can be adapted to suit your school context, as each will affect financial position and forecast.

Collaboration: How should finance committee members work together?

First and foremost, the ability to collaborate well requires everyone to understand their roles regarding the organization’s financial management. Leveraging their various skill sets, committee members work together to build ongoing conversations with one another, the CEO, the CFO, and the full board. Engaging each member’s background and insights facilitates healthy discussion, leading to actionable strategic plans and informed decision-making. Effective finance committees should also commit to making adequate time for the work at hand, earning one another’s trust, and coming prepared to fully engage.

For best results, CFOs and Finance Committee Chairs should plan to work together one-on-one in advance of committee meetings. This ensures that the right priorities and information are presented to the group for productive discussion and strategic decision-making. Working in close consultation with the CEO, this trio provides leadership for the larger board to consider academic investments with respect to financial guardrails. Especially amid complexity during the budget cycle, their collaboration with one another and the meaningful incorporation of their respective vantage points is critical to impact and sustainability.

Cadence: What is an effective meeting plan for a finance committee?

Finance committees should meet regularly, with an eye toward the seasonal “arc of the year”.

A sequenced meeting calendar notifies the board of decision-making timelines. It also mitigates the risk of smaller–but no less important–agenda items getting crowded out by a waterfall of more discussion-heavy priorities.

Prescheduling board meetings for the year can aid in the planning process for each meeting and provide predictability for committee members. Prescheduling also allows the committee to allocate the proper amount of time to items requiring a deep dive, ensuring that multiple major discussions or approvals do not end up on the same agenda.

Putting Effective Financial Governance in Action

Intentional financial governance increases impact and improves sustainability. If you don’t have an engaged, effective finance committee, it’s not too late to make it happen. Use the 5 Cs to help you determine where to invest your time. Want more hands-on support? Reach out to our team!

As the national leader in charter school financial planning services, we understand the unique challenges charter management organizations commonly face. We have partnered with more than 80 networks of all sizes, from single-site operators just getting started to the largest charter school organizations in the country. Our services for charter schools build finance capacity, strengthen financial sustainability inform school resource allocation, and strategically inform organizational decision-making on growth, facility affordability, debt financings, mergers, and restructurings. To learn more, contact Carrie Stewart.