Afton Conducts Professional Seminar on Innovation in Education for the University of Virginia’s MBA/MED Program

Key takeaways:

- Finance is only one of several pillars for assessing and sustaining innovation in education.

- Real-world content, including case studies, lessons learned, and application of financial best practices, is becoming increasingly valuable to help cultivate financial acumen in education leadership.

- The MBA/MEd program, established in 2012, helps develop financially sophisticated leaders for an industry that increasingly needs it.

In the summer of 2017, Afton was invited to participate and help facilitate an “Innovation in Education” seminar at the University of Virginia’s joint degree program in Business and Education (MBA/MEd). The program, established in 2012, was designed for the next generation of leaders in K12 education for whom “business skills are invaluable.”

“Afton leveraged its extensive experience leading financial innovation in school districts around the country to provide just what the students needed: an opportunity to wrestle with complex real-world financial challenges and ponder how they – as future district leaders – can best use effective financial planning to support schools and promote educational innovation. I am grateful that Afton shared its expertise in this way,” said Matthew Wheelock, Associate Professor of Education at the University of Virginia’s Curry School of Education.

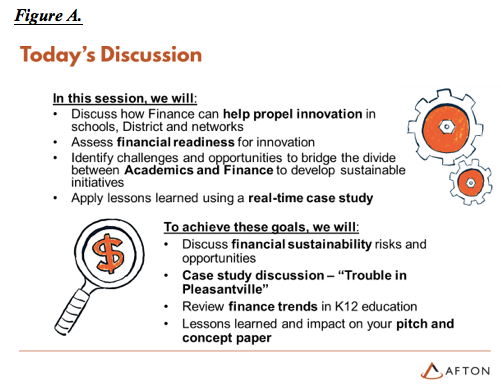

Afton’s Scott Milam and John Fahnenstiel worked with students and faculty from Curry and Darden to develop learning objectives (figure A) for attendees, and developed materials and content required to help meet those objectives. This experience highlighted two key items for Afton – a) there is a dearth of operationally focused course materials in education finance, and b) the demand for this type of content will increase as programs like UVA’s scale.

Course Content

To help provide context and facilitate a productive discussion, Afton shared recent learnings on sustaining innovative school models, as well as a case study, loosely based on Afton’s recent District work. Regarding sustaining innovation, Afton facilitated a discussion about some of its work in developing a “sustainability rubric” to evaluate risks and opportunities associated with innovative school models. We shared some typical financial metrics used to evaluate both school-level and district-level investments, as well as conditions required for sustainability beyond finance.

Additionally, Afton Partners’ associate John Fahnenstiel developed a case study entitled “Trouble in Pleasantville,” which shared the (not too unrealistic) story of a mid-sized District facing a looming financial deficit. The case study included profiles of key leaders and board members, the last three years of financial results and operating data, academic results, and key programmatic information and offerings at each school. Students were also given political and community context, as well as leadership turnover information, that could help as they contemplated alternatives for the school district.

Case Study Facilitation

Students were asked to take the role of Chief Financial Officer, and develop and share recommendations to the school board on how to address the financial challenge – both in the short and long-term. The resulting discussion focused on how the District could sustain some of its most important investments and innovative teaching practices while remaining solvent. The recommendations included short-term personnel and non-personnel trade-off decisions, in addition to adopting policies and practices (as well as creating a culture) that prevents this type of “crisis” from happening again.

Outcomes and Lessons Learned

This seminar revealed at least two key learnings for Afton – a) higher education institutions preparing the next generation of financial leaders in K12 public education need more content and real-life examples and b) K12 public education needs more financially sophisticated leaders coming out of programs like UVA’s program. Afton is committed to leveraging our work and lessons learned to improve the financial acumen of public education leaders through formal programs, professional development, technical assistance or any other mechanism to help sustain high-impact academic programs (and to avoid financial crises, as the one highlighted in our case study).

We also know that meeting our mission of “sustaining effective academic initiatives and outcomes” in the long-term will be greatly enhanced as the industry gains more talented financial leaders (or academic and operational staff with more financial acumen), and values these leaders appropriately. The joint degree program at the University of Virginia is designed to prepare the next generation of education reform leaders, “for whom business skills are invaluable.”

Without an increase in financial sophistication in the industry, Districts, Charters and their stakeholders may be destined to repeat the cycle of financial “crises” that have so often happened in the past. Given the recent trends in K12 public education, including limited increases in recurring public funding, and expanding choice offered to parents around the country, the urgency to strategically manage resources has never been greater. If supporting a program like UVA’s can help move the needle, we are all in.